Ponad 110-osobowy zespół prawników SPCG świadczy usługi prawne w zakresie kompleksowej obsługi podmiotów i przedsięwzięć gospodarczych. Doradzamy projektowo i w trybie helpdesk, realizujemy złożone projekty wymagające szerokiego spektrum doświadczenia i wiedzy prawniczej.

Trzydzieści lat doświadczenia w postępowaniach sądowych i arbitrażowych. Setki spraw przed sądami powszechnymi i Sądem Najwyższym, kilkaset sporów arbitrażowych przed sądami polubownymi stałymi i ad hoc, a także postępowań sądowoadministracyjnych.

Kompleksowe doradztwo prawne i regulacyjne dla sektora finansowego (banki, instytucje kredytowe, domy maklerskie, TFI, fundusze i firmy inwestycyjne, ubezpieczyciele, PTE) oraz reprezentacja przed krajowymi regulatorami (KNF, KDPW, GPW, UOKiK).

Całościowe doradztwo w realizacji inwestycji, w tym M&A, restrukturyzacje, nabywanie nieruchomości, proces budowlany, ochrona środowiska, kwestie podatkowe, partnerstwo publiczno-prywatne, zamówienia publiczne.

Kompleksowe usługi doradcze w zakresie indywidualnego i zbiorowego prawa pracy oraz ubezpieczeń społecznych (m.in. bieżący helpdesk, due dilligence z zakresu prawa pracy, reprezentacja w sporach sądowych oraz w postępowaniach z zakresu ubezpieczeń społecznych).

Doradztwo m.in. w zakresie ochrony danych osobowych i big data, przeciwdziałania praniu brudnych pieniędzy, prawa konkurencji, prawa autorskiego, prawa własności intelektualnej i przemysłowej, prawa telekomunikacyjnego, nowych mediów i IT, w tym dla sektora startupów.

Jeżeli szukasz konkretnej specjalności zobacz pełną listę lub skorzystaj z wyszukiwarki.

Kancelaria prawna

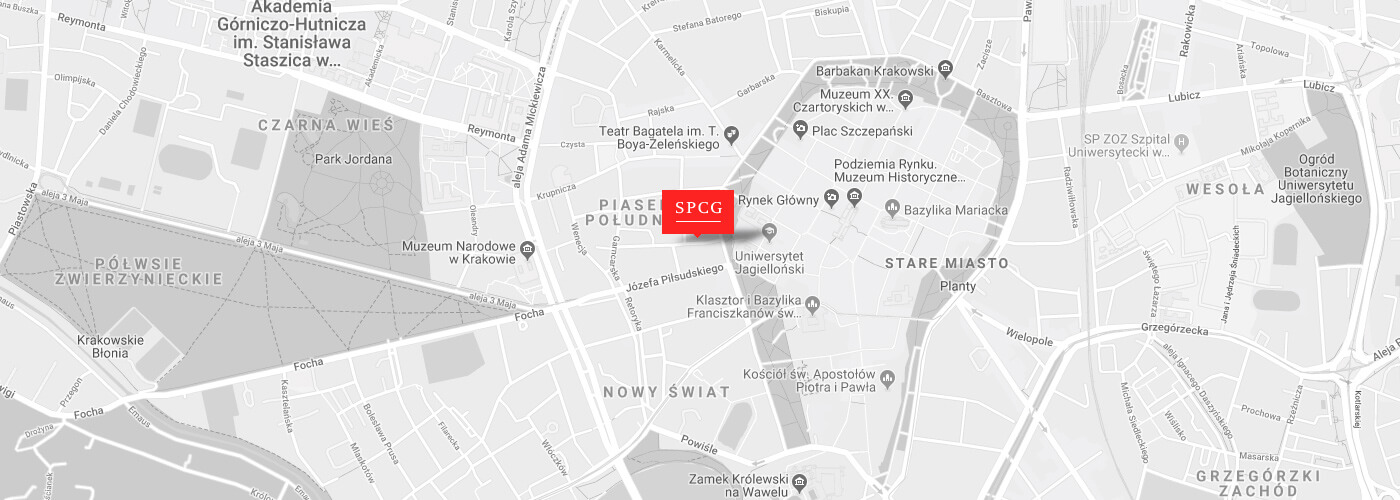

w Krakowie:

ul. Jabłonowskich 8

31-114 Kraków

Kancelaria prawna

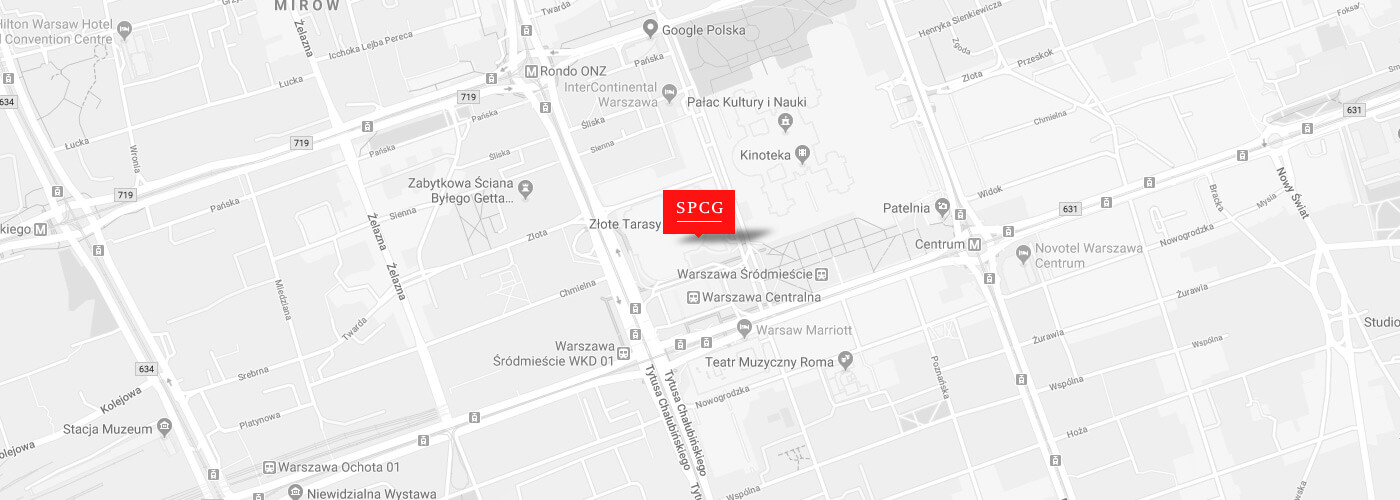

w Warszawie:

ul. Złota 59

00-120 Warszawa

Kancelaria prawna

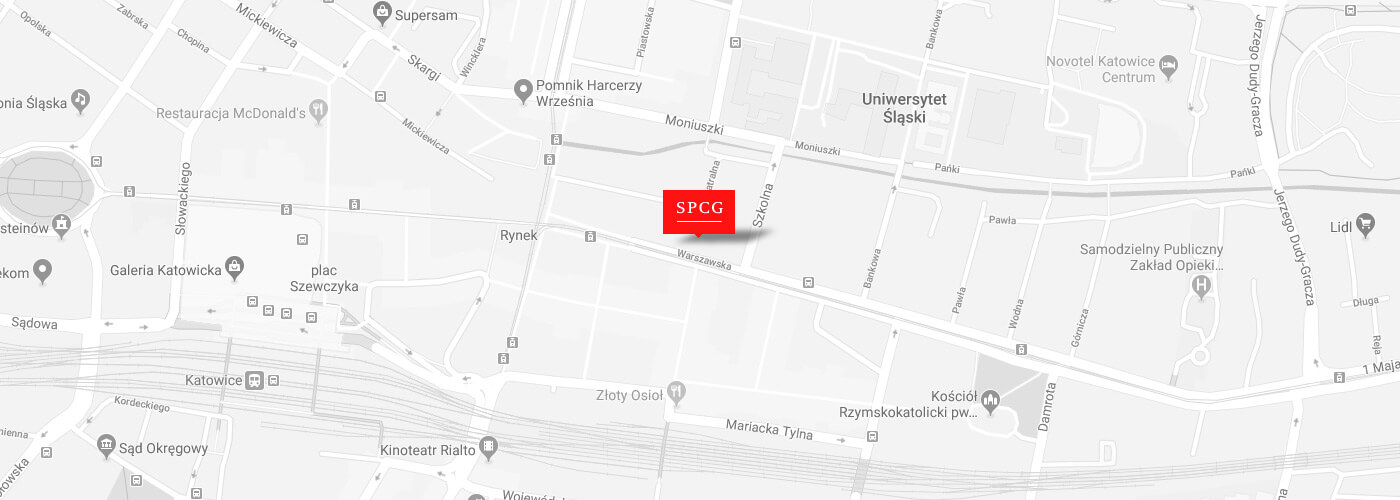

w Katowicach:

ul. Warszawska 10

40-006 Katowice

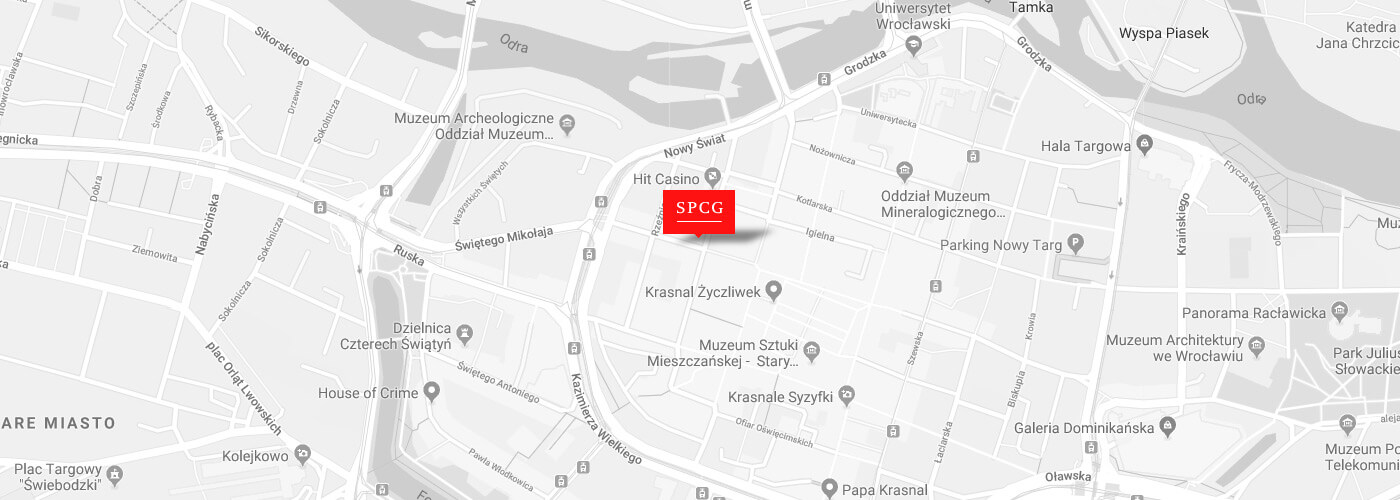

Kancelaria prawna

we Wrocławiu:

ul. św. Mikołaja 7

50-125 Wrocław

Korzystając ze strony, wyrażasz zgodę na wykorzystywanie plików cookies w celu zapewnienia prawidłowego działania strony, w celach statystycznych oraz w celach optymalizacji korzystania ze strony. Możesz zmienić ustawienia cookies w swojej przeglądarce. Zobacz Politykę prywatności.